14 July 2022 — Today, Flourish FI, a financial company founded in Berkeley and perfected in Brazil, was announced as one of eight global winners of the inaugural round of grants from the Mastercard Strive Community Innovation Fund.

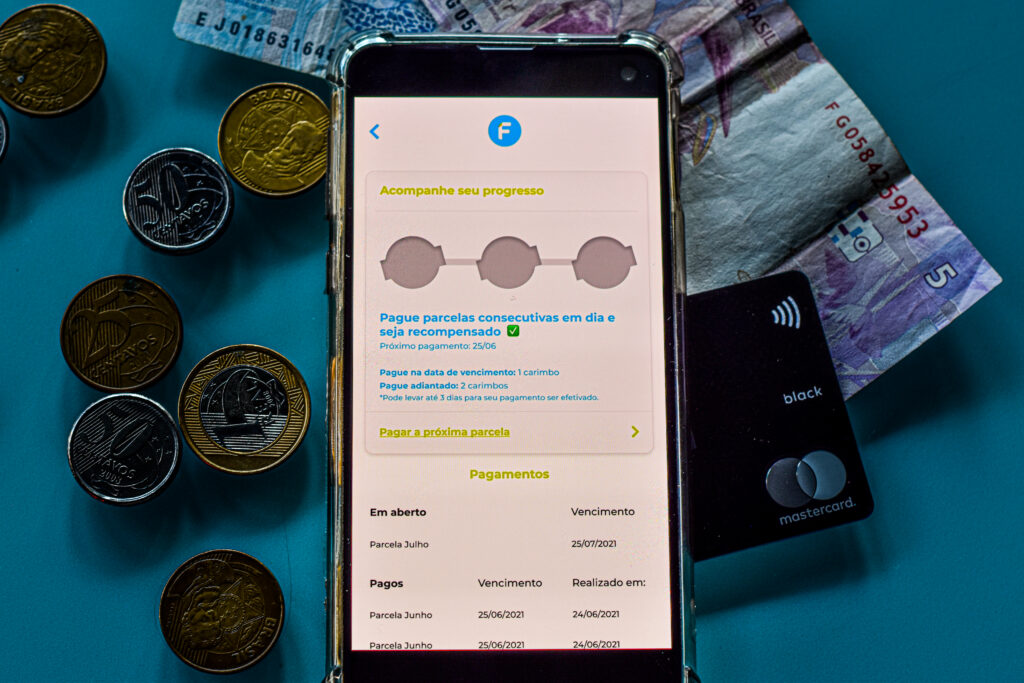

The digital rewards and engagement platform for financial institutions, will receive a share of $1 million in total grant funding towards their work in making personal finance more accessible and rewarding, helping the public and small-business owners in Brazil to make better financial decisions.

Before the COVID-19 pandemic, 70% of Latin Americans had no money saved, but due to the rapid digital transformation seen since 2020, millions of Brazilians have been digitized through government programs. The Innovation Fund grant will allow the company to test out new in-platform mechanics to help individuals and small-businesses achieve their goals through developing positive financial habits.

“We are excited and proud to be one of the winners of Mastercard Strive Innovation,” said Pedro Moura, CEO & Co-Founder of Flourish FI. “The mission-alignment between Flourish FI and Mastercard of ‘Doing well by doing good’ will foster new solutions to help small businesses and their owners drive positive money habits in Latin America.”

Small businesses, like the ones being supported by Flourish FI’s innovations, are essential agents of inclusive growth, with estimates indicating that they provide 70% of total employment worldwide. This is even more prevalent in low-income countries, with around 90% of employment stemming from businesses with under 10 employees. In Latin America and the Caribbean, small businesses account for over 99.5% of firms in the region and almost two-thirds of employment. Flourish FI, alongside the seven other awardees, is transforming how small businesses operate – and are supported – in a world that is rapidly digitizing.

Strive Community is a global philanthropic initiative launched by the Mastercard Center for Inclusive Growth in partnership with Caribou Digital. The initiative is focused on strengthening the resilience of small businesses and supporting their growth. Since companies that struggle to make effective use of new technologies risk being left behind, the Innovation Fund was established to spark truly innovative, digital, and data-first solutions that will boost small businesses’ efforts to go digital.

“Digital technologies are rapidly transforming the way businesses interact with their customers, with their employees, and with a global marketplace,” said Shamina Singh, President of the Mastercard Center for Inclusive Growth. “These Innovation Fund grantees are all introducing creative solutions that have potential to not only ease the challenges of digitization for small businesses, but unlock its promise, enabling them to grow and thrive.”

Flourish FI Named to 2021 Inclusive Fintech 50 [Newest Cohort]

The other winners, which were chosen from more than 650 applicants globally, are as follows:

- XR Global, Brazil

- Testing the potential of virtual reality (VR) to upskill small businesses, by bringing learners into immersive experiences.

- Open Contracting Partnership, USA/Colombia

- Creating a marketplace that leverages open data about government contract awards to seamlessly connect small businesses winning contracts with financial institutions who can offer them credit.

- FUNDES, Mexico, Guatemala, Peru, Colombia

- Connecting traditional merchants to the most appropriate digitization tools by creating a marketplace.

- Connecting traditional merchants to the most appropriate digitization tools by creating a marketplace.

- ChatGenie, Philippines

- Building new features that reduce friction in the sales process for small businesses selling via social commerce. The solution also enables management of multiple social commerce channels within a single app.

- Boost Capital, Cambodia

- Scaling up smartphone enabled loans and financial education, and jumpstarting the creation of a virtuous cycle in which businesses engaging in digital financial education are rewarded with better access to financial services.

- Novek, Kenya

- An Internet-of-Things enabled dispensing machine for powder-based goods, to reduce stock outs, increase sales by dispensing in quantities customers can afford, and eliminate single-use packaging.

- An Internet-of-Things enabled dispensing machine for powder-based goods, to reduce stock outs, increase sales by dispensing in quantities customers can afford, and eliminate single-use packaging.

- Boost Technology Ltd, South Africa, Nigeria

- Trialling a new service that combines data analysis, behavioural science and conversational commerce to empower small retailers with insights to make them more resilient.

Small businesses can learn more about the Strive Community, funding, and partnership opportunities by visiting www.strivecommunity.org and signing up to receive email updates.