Financial Wellness platform Flourish raises $ 1.5m in seed round

Berkeley startup uses gamification and loyalty programs to develop a financial wellness platform to provide banks, retailers and fintechs with a solution for revenue growth and customer retention

Berkeley, CA- With clients in the US, Bolivia and Brazil, Berkeley-based startup Flourish announces it has raised $ 1.5m in its first institutional round, led by Brazilian venture-capital firm Canary. Founded by Pedro Moura and Jessica Eting, Flourish FI offers an engagement and financial wellness solution for banks, fintechs and credit unions.

The round, announced today, also includes Xochi Ventures, First Check Ventures, Magma Capital and GV Angels; strategic angels including Rodrigo Xavier (former Bank of America CEO in Brazil), Beth Stelluto (former Schwab), Gustavo Lasala (president and CEO of The People Fund) and Brian Requarth (Founder of Viva Real).

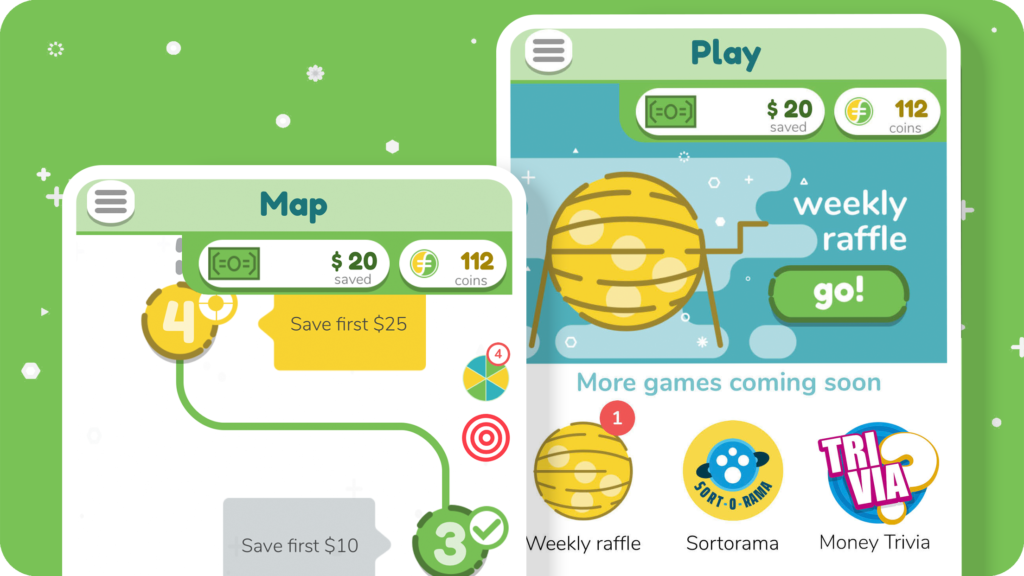

“In an increasingly competitive scenario for traditional banks and fintechs, the financial sector needs to reinvent itself. Engaging and retaining clients is key,” says Pedro Moura, co-founder and CEO of Flourish. The Flourish solution includes three main modules. The first is a rewards engine that incentivizes users to save or invest money while working towards their financial goals. The second is an intelligent and automated micro-savings feature where users can create personalized rules like every time your favorite sports team wins, automatically transfer $15 dollars into your rainy day fund. The third is a financial knowledge module, where personal financial transactions and spending patterns are turned into a question and answer game. At the end of the day, the purpose is to empower people to build positive financial habits while giving financial institutions more loyal customers.

In the US, Flourish started its activities testing end-user mechanics with mission-aligned organizations such as CommonWealth and OpportunityFund. They released a B2C version of the Flourish app in 2019, as a pilot for its banking platform that has helped non-savers save $600 on average in six months. Flourish has also partnered on pilot projects with Sicoob, a local cooperative bank in Brazil, and BancoSol, in Bolívia. Interested banks can easily integrate with the Flourish platform through a SDK or an API. Flourish generates revenue through a partnership model that focuses on user activation and engagement.

From an immigrant background, founders met in MBA program at UC Berkeley

Born in Natal, one of the biggest cities in Northeast Brazil, Moura emigrated to the US when he was a teenager, with his mother, looking for a better quality of life. During high school, he delivered newspapers and cleaned houses, soon learning the importance of managing his own money. Later, he graduated in Economics from UC Davis and worked in companies like JP Morgan Chase and Oportun.

Daughter of a filipino-father and a mother of mexican-descent, Eting also soon understood the importance of making her own money. After graduating in Ethnic Studies at UC Berkeley, she spent the most of her career working as an investor and operations lead in the philanthropic sector, at places including ZeroDivides and College Futures Foundation.

Pedro and Jessica met at Haas School of Business at UC Berkeley, where they both were pursuing a Masters in Business Administration. They connected with the idea of establishing a business that empowered people to create positive money habits and understand their finances. “For me and Jessica, it is very important to have an innovative and scalable solution that has a meaningful impact on a person’s financial future,” says the CEO.

With a 10+ person team spread across the US, Mexico and Brazil, Flourish serves financial institutions in the US and LATAM. The money raised in this round will help the company increase their number of customers in Latin America, expand the team, and develop new functionalities for the Flourish platform.

On Flourish

Founded by Pedro Moura and Jessica Eting, Flourish develops rewards and engagement solutions for financial institutions. With clients in the US, Bolivia and Brazil, the company has raised $ 1.5 million in a round led by Brazilian venture capital firm Canary. Other investors include Xochi Ventures, First Check Ventures, GV Angels, Magma Partners and strategic angels in the company also include Rodrigo Xavier (former Bank of America CEO in Brazil), Gustavo Lasala (CEO of The People Fund), Beth Stelluto (former Schwab VP) and Brian Requarth (founder of VivaReal).