Game-elements for financial institutions

Gamification for financial institutions has become increasingly popular in mobile applications and digital banking, as businesses seek to enhance user experience and drive customer engagement.

The use of game elements and design in non-game contexts to motivate and engage people to achieve their goals have been game changers in many industries. We have experienced successful usage of game-elements in Health with apps like Strava, Nike + and Peloton, in Education with apps like Dualingo, as well as dating with apps like Tinder and Bumble. Financial institutions can use this technique to increase financial wellbeing, and promote responsible financial behavior.

What are some game elements that can be used in gamification for financial institutions?

- Points and rewards, and instant gratification: most people want to be recognized and rewarded for their actions and achievements. This is no different when managing one’s money. Using points and rewards are often involved to incentivize desired behaviors. For example, customers can earn points for completing tasks like saving money, setting up a direct deposit, paying bills on time, or using a credit card responsibly. These points can be redeemed for cashback, discounts, or other rewards.

- Progress bars and levels: Progress bars, level systems and badges can be used to track user progress and encourage continued engagement. An example of this is the customer earning points for logging into the bank’s app daily. This is interesting from the customer’s point of view not only because of the implicit benefit (points) but also because of the positive habit of checking their bank account balance, seeing if there are any outstanding bills, etc. For the institution, this customer is entering the bank’s “showcase” daily, seeing new product or service suggestions and increasing their contact and engagement with the brand.

- Challenges: Another common use is setting challenges and competitions to encourage motivated clients to achieve their goals. For example, a financial institution could use gamified quests to help their clients learn about financial planning by providing a series of challenges that teach them how to create a budget, save for retirement, or invest in the stock market.

What problems can be solved with game-elements for financial products?

When we talk about using gamification for engaging customers with their financial institutions, we understand that a gamified solution could be used to tackle different challenges and specific goals. By breaking down complex concepts or processes into smaller, more manageable tasks or challenges, mobile applications and digital banking can also help customers better understand how to use their services. That is why Flourish Fi’s technology is modular and can be combined in different ways creating a personalized experience for each one of our clients.

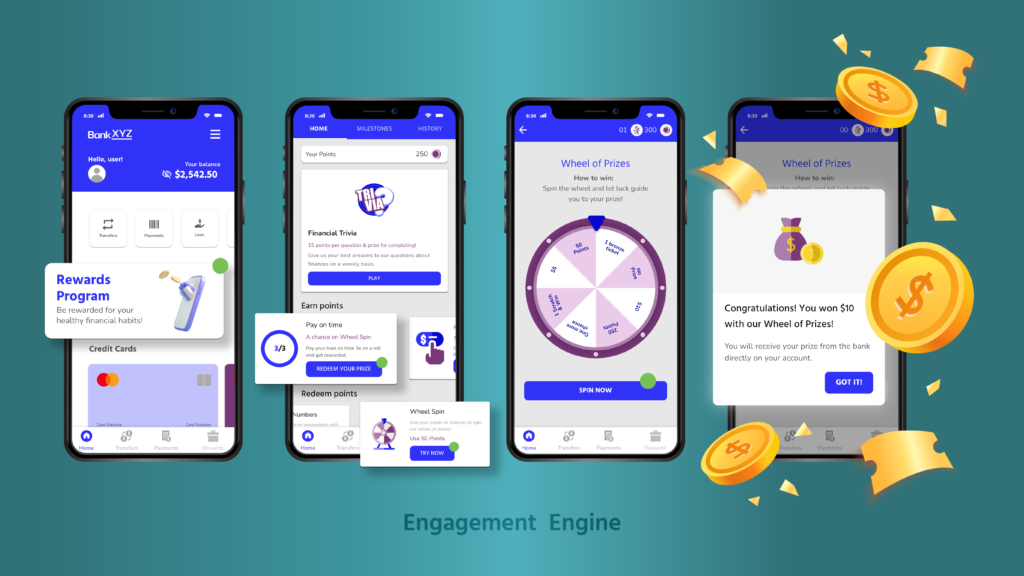

Knowing that gamification is a powerful tool for engaging and encouraging responsible financial behavior, our technology transforms the user’s financial activity into a fun and engaging experience which ultimately generates behavioral consumer insights for our partners. Here is and example of how our models can be combined to create personalized journeys:

One common challenge that financial institutions have is to increase the number of customers in digital channels to avoid the costs with physical branches, especially as the younger generation point to the future of financial services being fully digital.

In order to incentivize channel adoption, our customers can combine different mechanics in our platform including Personalized Mission, Financial knowledge and Instant Win Activities. These combine bring people a guided journey, timely and relevant content in a fun manner while also rewarding people for accomplishing their goals.

With this combination, customers have a journey that starts with completing the challenge of making an on-time loan payment, then earning extra points by playing a financial knowledge trivia, to finally transform those points into prizes with the game mechanics of a wheel of prizes or a scratch and win, and everything inside the financial institution app.

In conclusion, gamification is a powerful tool for enhancing user engagement, promoting learning and retention, improving customer loyalty and satisfaction, and gaining valuable insights into user behavior. By incorporating game design principles into your mobile applications and digital banking services, you can create a more enjoyable, interactive, and rewarding experience for your customers, ultimately driving higher levels of engagement and growth.